Understanding the benefits of financial planning can significantly transform your life, providing you with a roadmap to achieve your financial goals and peace of mind. Financial planning helps you manage your income, understand your spending patterns, and make informed investment decisions. It ensures that you are prepared for unexpected expenses and helps you build a secure future for yourself and your loved ones. By taking control of your finances today, you can enjoy the freedom and security that come with knowing you are on the right path to achieving your financial dreams. Have you ever wondered about the benefits of financial planning? Maybe you’re thinking it’s just about budgeting or saving a bit each month. Well, it’s much more than that! Financial planning can transform your financial landscape, keep you stress-free, and help you achieve your life goals.

Understanding Financial Planning

Let’s start by understanding what financial planning is. It’s a comprehensive evaluation of your financial state and future scenarios, involving setting goals, identifying resources, and strategizing to achieve your aspirations. It’s like your financial GPS, guiding you to make informed decisions and navigate through uncertainties.

Why Is Financial Planning Important?

Financial planning is important because it gives you control over your financial future. Picture this: without a plan, you might be wandering aimlessly through your financial life, hoping things will just work out. But with a plan, you know exactly where you’re headed, what you need to do, and how to handle unexpected roadblocks.

Key Benefits of Financial Planning

Let’s dive into the specific benefits of having a well-thought-out financial plan.

Financial Security and Peace of Mind

One of the most significant benefits is financial security. With a plan, you’re not living paycheck to paycheck, worrying about unexpected expenses. You have an emergency fund, insurance coverage, and a strategy for managing debt, providing you with peace of mind.

Achieving Financial Goals

Financial planning helps you set and achieve your goals. Whether it’s buying a house, starting a business, or retiring comfortably, a financial plan outlines the steps you need to take. It keeps you focused and motivated, turning your dreams into achievable targets.

Better Budgeting and Spending

A good financial plan includes a detailed budget. This helps you track your income and expenses, ensuring you’re living within your means. You’ll be less likely to splurge on unnecessary items, and more likely to prioritize your spending on what truly matters to you.

Investment Planning

Investments are a crucial part of financial planning. By evaluating your risk tolerance and financial goals, you can make informed decisions about where to invest your money. This can help grow your wealth over time, providing a solid financial foundation for the future.

Tax Efficiency

No one wants to pay more taxes than necessary. Financial planning includes tax strategies to minimize your tax liabilities legally. This might involve tax-efficient investments, utilizing deductions and credits, or planning your withdrawals from retirement accounts.

Retirement Planning

Thinking about relaxing on a beach in your golden years? A financial plan ensures you’re saving enough for retirement. It also considers inflation, life expectancy, and your retirement lifestyle, so you’re not left scrambling in your old age.

Managing Debt

Debt can be overwhelming, but a financial plan helps you manage it effectively. Whether it’s credit card debt, student loans, or a mortgage, your plan will include strategies for paying it down or consolidating it, making it more manageable.

Steps in Financial Planning

Now that you know the benefits, let’s explore the steps involved in financial planning. It can seem daunting, but breaking it down into clear steps makes it manageable.

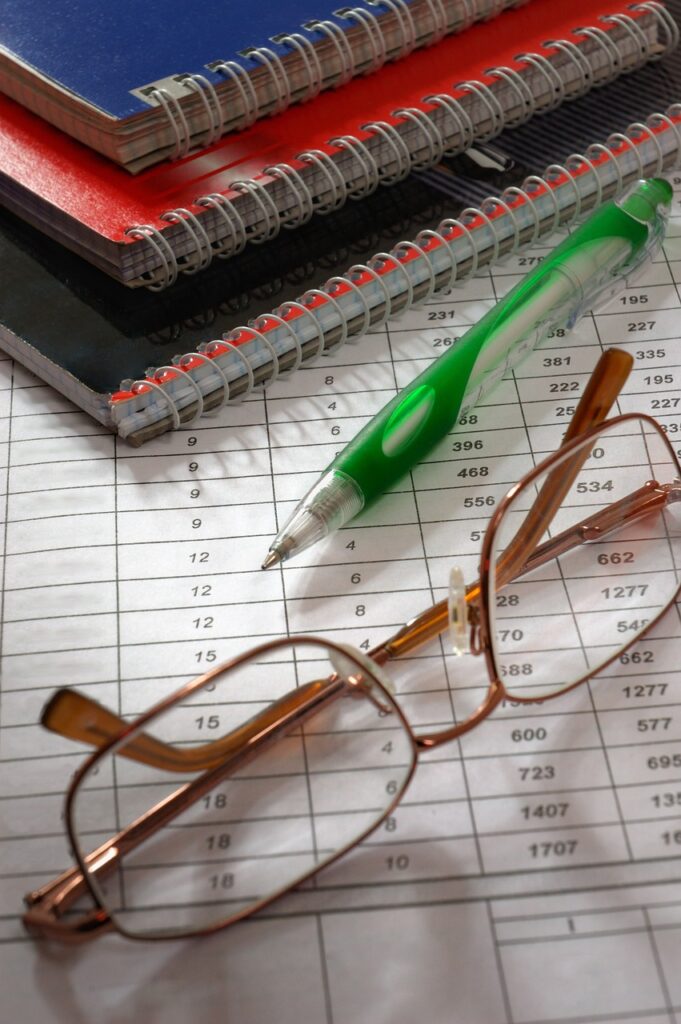

Assess Your Financial Situation

The first step is to assess your current financial situation. Gather information about your income, expenses, assets, and liabilities. This will give you a clear picture of where you stand financially.

| Category | Details |

|---|---|

| Income | Salary, bonuses, rental income, etc. |

| Expenses | Rent/mortgage, utilities, groceries, entertainment, etc. |

| Assets | Savings, investments, property, etc. |

| Liabilities | Credit card debt, loans, mortgages, etc. |

Set Financial Goals

What do you want to achieve? Your goals might be short-term, like paying off a credit card, or long-term, like saving for retirement. Be specific and realistic with your goals, and prioritize them based on their importance and timeframe.

Develop a Plan

Create a detailed plan to achieve your goals. This might include:

- Creating a budget

- Building an emergency fund

- Investing in retirement accounts

- Paying down debt

- Saving for specific goals (e.g., buying a home, child’s education)

Implement Your Plan

Once your plan is in place, it’s time to act. Start by making necessary adjustments to your budget, setting up automatic savings, or investing as planned. Stay disciplined and stick to your plan, even if it means making some sacrifices.

Monitor and Revise Your Plan

Life is unpredictable, and your financial plan should be flexible. Regularly review your plan and make adjustments as needed. This ensures that you remain on track to achieve your goals, no matter what life throws your way.

Common Mistakes in Financial Planning

Even with the best intentions, it’s easy to make mistakes. Here are some common pitfalls and how to avoid them:

Not Setting Clear Goals

Vague goals lead to vague plans. Be clear and specific about what you want to achieve. Instead of saying, “I want to save money,” say, “I want to save $10,000 in two years for a down payment on a house.”

Ignoring Expenses

Many people underestimate their expenses. Track every penny you spend to get an accurate picture of where your money goes. This will help you create a realistic budget.

Failing to Adjust Your Plan

Your financial circumstances will change over time, so your plan should, too. Regularly review and update your plan to reflect changes in your income, expenses, or goals.

Not Having an Emergency Fund

Life can be unpredictable. Whether it’s a medical emergency or a job loss, an emergency fund acts as your safety net. Aim to save at least three to six months’ worth of living expenses in a readily accessible account.

Overlooking Insurance

Insurance is a crucial part of financial planning. It protects you and your family from financial hardships due to unexpected events. Ensure you have adequate health, life, disability, and property insurance.

The Role of Financial Advisors

You don’t have to navigate financial planning alone. Financial advisors can provide invaluable assistance, helping you create a tailored plan and stay on track.

What Financial Advisors Do

Financial advisors offer expert advice on a wide range of financial matters, from budgeting and saving to investing and retirement planning. They can help you:

- Assess your financial situation

- Set realistic goals

- Develop and implement a plan

- Provide unbiased advice and recommendations

- Monitor and adjust your plan

Choosing a Financial Advisor

When selecting a financial advisor, look for:

- Credentials: Certifications like Certified Financial Planner (CFP) or Chartered Financial Consultant (ChFC).

- Experience: A track record of success in advising clients with similar financial situations.

- Fiduciary Duty: Advisors who act in your best interest, rather than their own.

- Fee Structure: Understand how they are compensated (fee-only, commission-based, or a combination).

The Future of Financial Planning

Financial planning is not a one-time event but an ongoing process. As your life evolves, so should your financial plan. Keep learning, stay disciplined, and adapt to new situations to ensure long-term financial success.

The Impact of Technology

Technology is transforming financial planning, making it more accessible and efficient. From budgeting apps to robo-advisors, there are numerous tools available to help you manage your finances. Embrace these technologies to enhance your financial planning process.

Financial Literacy

Financial literacy plays a critical role in effective financial planning. Educate yourself about personal finance principles and stay informed about financial trends. This knowledge will empower you to make better decisions and achieve your goals.

Conclusion

Financial planning is an invaluable tool that can transform your financial health and help you achieve your life goals. By understanding its benefits and following the steps to create and maintain a plan, you can secure your financial future and live with peace of mind. Whether you’re just starting or looking to refine your existing plan, the key is to stay proactive, informed, and adaptable. Happy planning!